How Personal Loans copyright can Save You Time, Stress, and Money.

How Personal Loans copyright can Save You Time, Stress, and Money.

Blog Article

10 Simple Techniques For Personal Loans copyright

Table of ContentsAn Unbiased View of Personal Loans copyrightPersonal Loans copyright Fundamentals ExplainedPersonal Loans copyright - QuestionsPersonal Loans copyright Can Be Fun For EveryoneMore About Personal Loans copyright

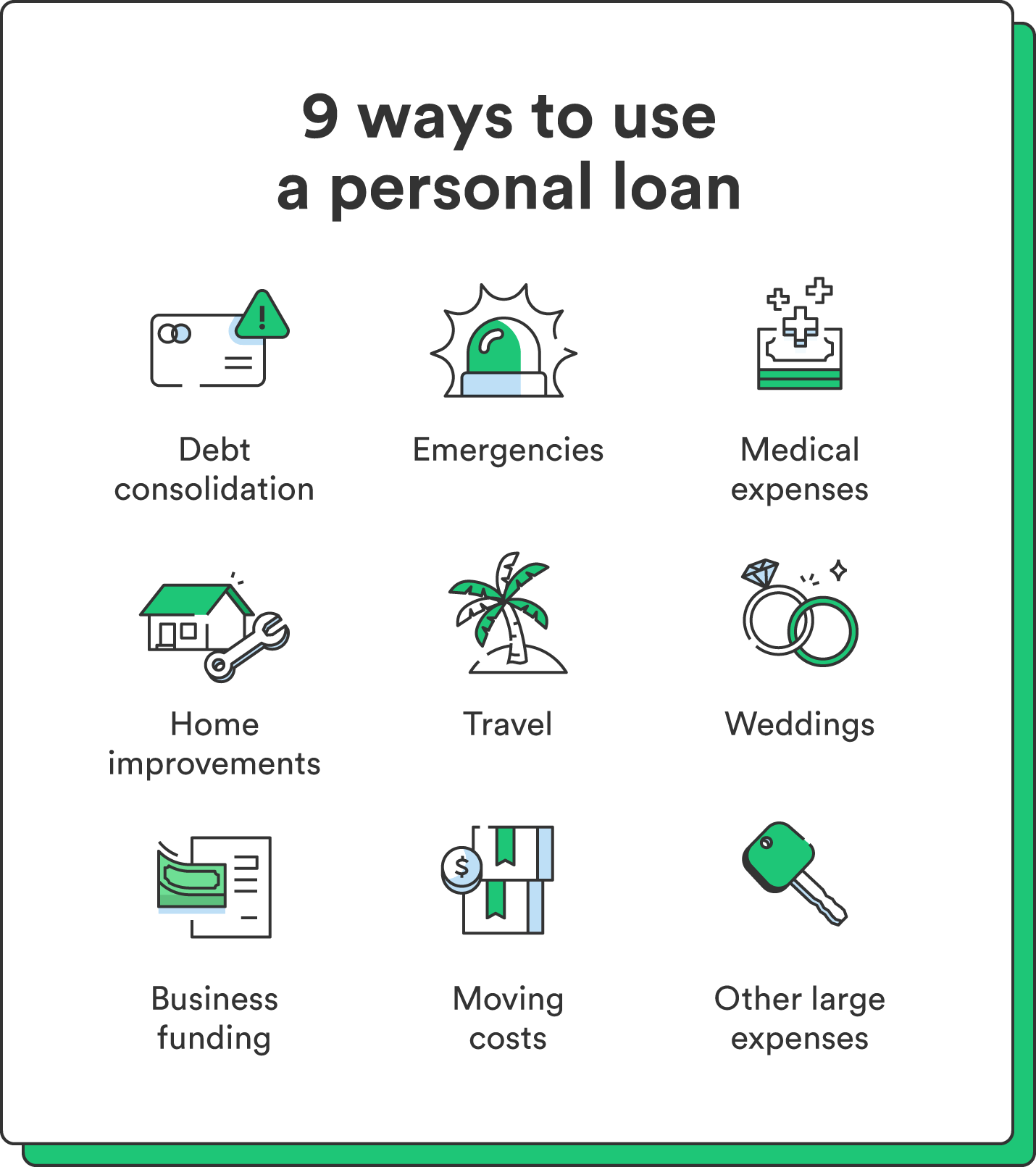

Allow's dive right into what an individual funding really is (and what it's not), the factors people use them, and just how you can cover those crazy emergency expenses without taking on the concern of debt. An individual car loan is a round figure of cash you can borrow for. well, almost anything., yet that's technically not an individual lending (Personal Loans copyright). Individual loans are made with a real financial institutionlike a bank, debt union or on the internet lending institution.

Let's have a look at each so you can understand exactly how they workand why you do not require one. Ever before. Most personal financings are unsecured, which implies there's no security (something to back the loan, like a cars and truck or residence). Unsecured fundings commonly have greater rates of interest and need a much better credit rating rating because there's no physical item the lender can remove if you don't pay up.

Some Of Personal Loans copyright

Stunned? That's okay. No issue just how great your credit is, you'll still need to pay passion on a lot of personal lendings. There's constantly a cost to pay for obtaining money. Protected personal loans, on the various other hand, have some type of collateral to "protect" the funding, like a boat, precious jewelry or RVjust among others.

You could likewise secure a safeguarded personal financing using your car as security. That's a hazardous move! You don't desire your main mode of transport to and from work getting repo'ed since you're still spending for last year's kitchen area remodel. Trust us, there's nothing safe about guaranteed fundings.

Simply since the settlements are foreseeable, it does not suggest this is a great bargain. Personal Loans copyright. Like we claimed previously, you're virtually ensured to pay interest on an individual car loan. Just do the math: You'll end up paying way much more in the lengthy run by securing a financing than if you would certainly simply paid with money

:max_bytes(150000):strip_icc()/Pay-Day-Loan-Personal-Loan-dfdeaa22f6ea4790b1c966fcd6c937cf.jpg)

Everything about Personal Loans copyright

And you're the fish hanging on a line. An installment finance is an individual financing you repay in taken care of installments gradually (normally when a month) up until it's paid completely - Personal Loans copyright. And don't miss this: You have to repay the initial finance quantity before you can borrow Visit Website anything else

Don't be misinterpreted: This isn't the exact same as a credit history card. With personal lines of credit, you're paying passion on the loaneven if you pay on time.

This one gets us provoked up. Due to the fact that these services prey on people who can not pay their expenses. Technically, these are temporary fundings that offer you your income in advance.

Indicators on Personal Loans copyright You Should Know

Due to the fact that points obtain genuine messy actual quickly when you miss out on a repayment. Those creditors will come after your pleasant grandma who cosigned the loan for you. Oh, and you need to never ever cosign recommended you read a car loan for anybody else either!

But all you're actually doing is making use of new debt to repay old financial debt (and prolonging your car loan term). That simply indicates you'll be paying even extra gradually. Companies recognize that toowhich is exactly why numerous of them provide you debt consolidation fundings. A lower rate of interest does not get you out of debtyou do.

And it starts with not obtaining any kind of even more cash. Whether you're assuming of taking out an individual financing to cover that kitchen area remodel or your frustrating credit report card bills. Taking out financial obligation special info to pay for points isn't the way to go.

How Personal Loans copyright can Save You Time, Stress, and Money.

And if you're thinking about a personal financing to cover an emergency, we obtain it. Obtaining cash to pay for an emergency just escalates the tension and hardship of the situation.

Report this page